Are you tired of watching the hard-earned profits from your stock investments get chipped away by capital gains taxes? Fear not! This comprehensive guide unveils a plethora of strategies on how to avoid capital gains tax on stocks. Imagine the satisfaction of knowing that you’re making the most of your investments while keeping more of your profits in your pocket. Get ready to dive into a world of tax-saving strategies, from holding stocks for longer periods to donating stocks to charity and leveraging tax-advantaged accounts.

This informative journey will explore the vital differences between short-term and long-term capital gains, tax brackets, rates, and state-level considerations. We’ll also discuss the importance of understanding the cost basis and its impact on your tax liabilities. By the end of this guide, you’ll be equipped with the knowledge to make informed decisions and maximize your investment returns while minimizing tax obligations and learning how to avoid capital gains tax on stocks.

Key Takeaways

- Understand capital gains tax on stocks, including short-term vs. long-term rates and brackets.

- Utilize strategies such as holding for extended periods, investing in tax-advantaged accounts, and utilizing tax loss harvesting to minimize capital gains taxes.

- Investigate state-specific rules & regulations regarding stock sales to maximize investment returns.

Understanding Capital Gains Tax on Stocks

Capital gains taxes are levied on the profits derived from the sale of an investment, such as stocks, bonds, or real estate, which contribute to your capital gains tax bill. These taxes apply to capital assets, including the capital asset that is intended for profit, such as tangible items like cars and boats. Remember, you only need to pay capital gains tax when they are realized – when the investment is sold.

Grasping the difference between short-term and long-term capital gains is key because it directly influences your tax liability. Short-term capital gains refer to profits from investments held for one year or less, while long-term capital gains are associated with capital assets held for more than one year. Long-term capital gains tax rates are usually lower than ordinary income tax rates. This can be favorable for individuals looking to maximize their returns.

Short-term vs. long-term capital gains

It is important to differentiate between short-term and long-term capital gains due to their tax implications. Here’s what you need to know:

- Profits from investments held for one year or less are classified as short-term capital gains.

- Long-term capital gains signify profits from the sale of an asset held for more than a year.

- The tax brackets for short-term capital gains are equivalent to those for ordinary income taxes.

- The tax rates for short-term capital gains can range from 10% to 37% based on your taxable income.

Conversely, long-term capital gains tax rates are notably lower for most assets. Here, the timing of your investments gains significant importance. Waiting a few days after a year of purchase can make the difference between being treated as a short-term capital gain and benefiting from the lower long-term capital gains tax rates. Timing maneuvers are more pertinent for higher tax brackets than lower ones and are more relevant for larger trades than smaller ones.

Tax brackets and rates for capital gains

Capital gains tax rates can be categorized into three brackets: 0%, 15%, and 20%. These rates apply to long-term capital gains, and the income thresholds for each rate vary depending on your filing status. For example, the income threshold for the 0% capital gains tax rate for single filers is up to $41,675 per annum, while the income threshold for the 20% capital gains tax rate for married filing jointly is more than $517,200.

Remember, certain types of investments are subject to varying tax rates. For instance, gains on collectibles are taxed at 28%, separate from the net investment income tax. Gains on qualified small business stock held for more than five years can also be taxed up to 28%. Awareness of these tax rates is vital in maximizing your investment returns while minimizing your tax liabilities.

Strategies for Minimizing Capital Gains Tax on Stocks

Having covered the basics of capital gains tax, we’ll now explore some useful strategies to avoid taxes and minimize their impact.

You can reduce your tax bill and boost your profits by:

- Holding stocks for longer periods to benefit from reduced long-term capital gains tax rates

- Investing in tax-advantaged accounts

- Employing tax-loss harvesting.

Tax-advantaged accounts, such as 401(k) plans, IRAs, and 529 college savings accounts, offer the perk of tax-free or tax-deferred growth, meaning selling investments within these accounts does not require the payment of capital gains tax. Additionally, tax-loss harvesting involves selling losing investments to offset the gains from winners, reducing the amount of taxable gains.

Holding stocks for longer periods

One of the simplest and most effective way to minimize capital gains tax on stocks is to hold onto them for more than a year. Doing so results in profits being classified as long-term gains, subject to lower tax rates than short-term gains. This strategy works especially well for investors in higher tax brackets, as the difference between short-term and long-term capital gains tax rates is more pronounced.

Remember that the maximum tax rate on ordinary income is generally higher than the maximum tax rate on capital gains. Holding your investments for over a year enables you to benefit from lower long-term capital gains tax rates, thereby optimizing your returns.

Investing in tax-advantaged accounts

Tax-advantaged accounts, such as:

- 401(k)s

- traditional IRAs

- solo (401K)s

- SEP IRAs

Offer a means of deferring capital gains taxes until the funds are withdrawn. Generally, capital gains taxes will not be incurred for the buying or selling assets within these accounts, provided that funds are not withdrawn before the IRS-defined retirement age of 59 1/2. This allows your investments to grow tax-deferred, maximizing your returns over time.

Other tax-advantaged accounts, such as Roth IRAs and 529 college savings plans, are funded with after-tax money and allow your investments to grow tax-free. When withdrawing money for qualified expenses such as retirement or college education, no federal income tax is owed on either the returns or initial investment. This is a great benefit of saving with a Roth IRA over other types of savings plans. Utilizing these tax-advantaged accounts allows you to accumulate wealth without the burden of capital gains taxes.

Utilizing tax-loss harvesting

Tax-loss harvesting is a valuable strategy that involves selling stocks at a loss to offset capital gains taxes. By selling losing investments, you can use the losses to offset gains from winning investments, reducing your overall tax liability. This can be particularly useful for investors with a mix of winning and losing stocks.

To employ tax-loss harvesting effectively, it’s important to be aware of the wash-sale rule, which states that an individual is not permitted to purchase a stock sold at a loss within 30 days to utilize the loss to offset capital gain. Keeping this rule in mind and strategically offloading underperforming stocks helps reduce your capital gains tax burden and boost overall investment returns.

Donating Stocks to Charity

Donating appreciated stocks to charity is another effective strategy for avoiding capital gains tax and receiving a charitable donation tax deduction. Not only do you get to support a cause you’re passionate about, but you also reap the benefits of tax savings.

When donating stocks to charity, you can deduct the full market value of the stocks from your taxes. To donate stocks, you can simply transfer the stocks to the charity’s brokerage account.

Maintaining records of the transfer, such as the transfer date, the number of shares transferred, and the stock’s fair market value at the transfer time, is imperative. This way, you can ensure that your donation is properly documented for tax purposes.

Benefits of donating stocks

Donating stocks to charity offers several advantages, including providing a greater donation amount than with cash, potential tax deductions, and the elimination of capital gains tax. Donating appreciated stocks to charity allows you to avoid paying capital gains tax on the stock’s appreciation.

In addition, you may receive a tax deduction for the full market value of the stock at the time of the donation. This strategy can be particularly beneficial for investors who have stocks with significant appreciation and want to make a charitable donation.

Donating the stocks directly, rather than selling them and donating the cash proceeds, enhances your tax savings and allows for a larger contribution to your preferred charity.

How to donate stocks

To donate stocks to charity, follow these steps:

- Select a qualified charity that aligns with your values and interests.

- Research to verify the charity’s qualifications and examine their financials to confirm their credibility.

- Verify the charity’s tax-exempt status.

Next, contact the charity to ascertain if they accept stock donations. Once you have confirmed that the charity accepts stock donations, contact your broker to initiate the stock transfer. The paperwork and information necessary to complete the transfer may differ depending on the charity and broker, but generally, you’ll need to provide the following:

- The charity’s name

- The charity’s address

- The charity’s tax ID number

- The number of shares being donated

- The stock’s ticker symbol

After completing the transfer, request a receipt or acknowledgment from the charity for tax purposes.

Understanding Cost Basis and Stock Sales

Understanding the concept of cost basis is vital when selling stocks, which is the original value of an asset for tax purposes, typically the purchase price adjusted for stock splits, dividends, and return of capital. Accurately determining the cost basis is necessary to compute your capital gains or losses when selling an investment, affecting your capital gains tax liability.

There are several methods available for determining cost basis, including:

- The original purchase price

- Adjustments for stock splits

- Adjustments for dividends

- Adjustments for return of capital

Selecting an appropriate method for calculating cost basis can considerably affect your capital gains tax liability and overall returns on investment.

Methods for calculating cost basis

FIFO (First-In, First-Out) and LIFO (Last-In, First-Out) are common methods used to calculate the cost basis. Other options include dollar value LIFO, average cost for mutual fund shares, and specific share identification.

The FIFO method assumes that the first shares acquired are the ones to be sold first, while the LIFO method assumes that the last shares purchased are the first shares sold.

The specific share identification method allows investors to select which shares they wish to sell, enabling them to pick the shares with the most economical cost basis, thus minimizing their capital gains tax burden. Knowing these methods and choosing the best fit for your investment strategy can significantly impact your tax liabilities and investment returns.

Recordkeeping for cost basis

Maintaining accurate records for cost-basis calculations and tax reporting is critical to prevent errors or penalties and enhance investment returns. Maintaining detailed records of transactions, including the purchase price, any adjustments, and the sale price, is necessary to identify the cost basis of your investment.

Furthermore, tracking any changes in the cost basis arising from stock splits, dividends, or other adjustments is necessary, as well as the date of purchase and sale of the stock. By keeping accurate records and understanding the different methods for calculating cost basis, you can make informed decisions when selling stocks and minimize your capital gains tax liabilities.

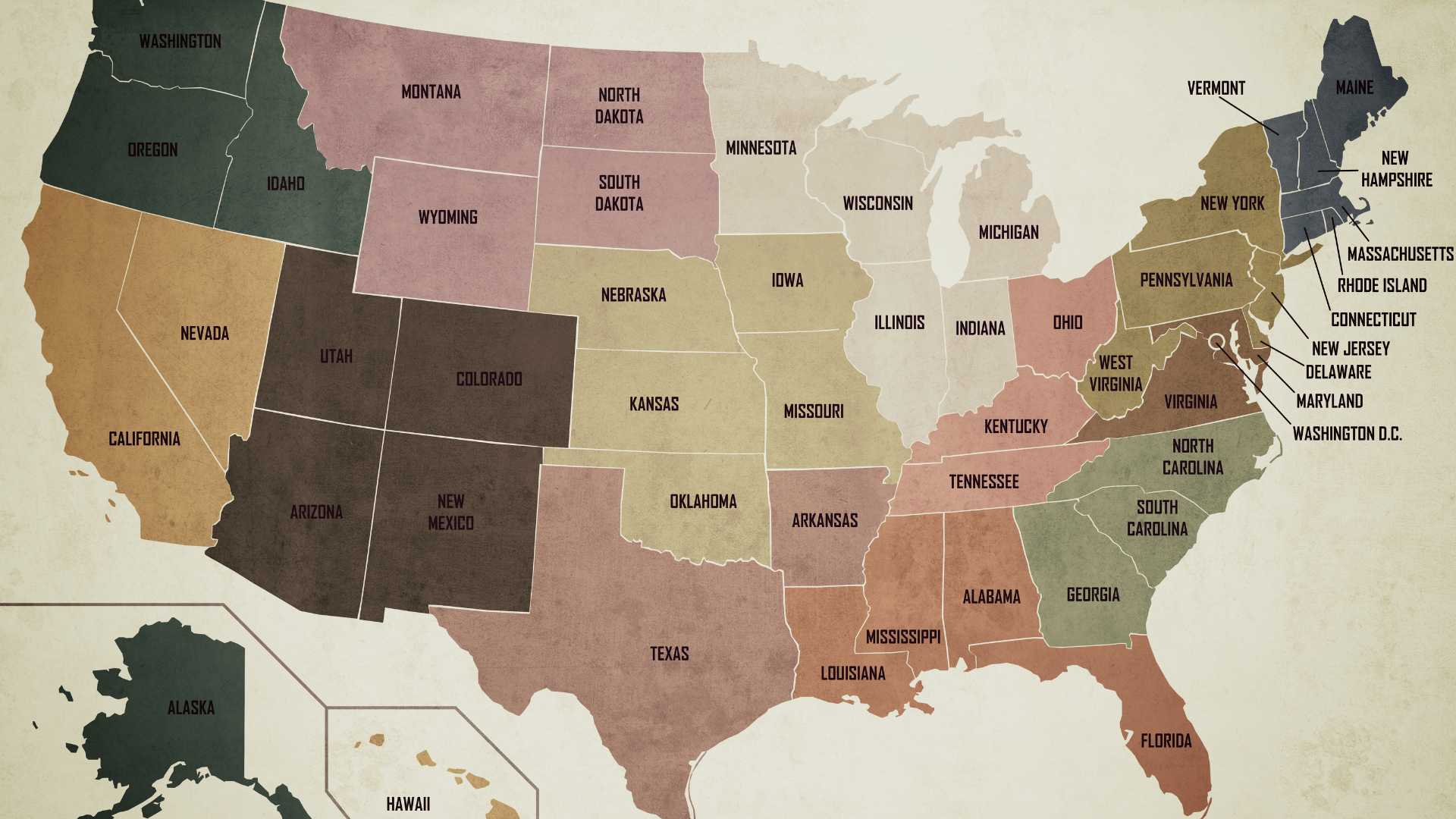

State Capital Gains Taxes on Stocks

You may be liable for federal capital gains taxes on your stock investments. Additionally, state capital gains taxes may also apply. State tax rates and rules vary for capital gains taxes on stocks, so understanding your state’s regulations is essential for accurately calculating your tax liabilities. Some states even have lower taxes on long-term capital gains than on ordinary income.

To reduce state capital gains taxes, consider the previously discussed strategies like maintaining stocks for extended durations, investing in tax-advantaged accounts, and utilizing tax-loss harvesting. Understanding state-specific tax rules and implementing these strategies can further reduce your overall capital gains tax burden.

State tax rates and rules

State tax rates and rules for capital gains taxes on stocks differ from state to state, making it essential to consult the pertinent tax laws of your state or obtain professional counsel for precise and current information. Some states have specific tax laws regarding capital gains taxes on stocks, including:

- Alaska

- Florida

- Nevada

- South Dakota

- Tennessee

- Texas

- Washington

- Wyoming

These states do not levy an income tax, while others have lower taxes on long-term capital gains than on ordinary income.

Knowing your state’s tax rates and rules can significantly impact your capital gains tax liabilities. Ensure that you stay informed about any changes in state tax regulations and consult professional advice if needed to make the most of your investment returns.

Strategies for minimizing state capital gains taxes

Many of the strategies mentioned earlier can also help minimize your state capital gains taxes. Here are some valuable strategies for reducing your state capital gains tax burden.

- Investing in the long-term

- Making use of tax-deferred retirement plans

- Utilizing capital losses to offset gains

- Donating appreciated stock

- Applying tax-loss harvesting

Additionally, consider timing your stock sales to take advantage of lower state tax rates or waiting until you move to a state with more favorable tax rules. By employing these strategies and staying informed about state-specific tax regulations, you can effectively minimize your state capital gains taxes and maximize your investment returns.

Summary

Throughout this comprehensive guide, we’ve explored various strategies for minimizing capital gains tax on stocks, including holding stocks for longer periods, investing in tax-advantaged accounts, utilizing tax-loss harvesting, and donating stocks to charity. We’ve also discussed the importance of understanding the cost basis when selling stocks and the impact of state capital gains taxes on your overall tax liabilities.

By implementing these strategies and staying informed about the ever-changing tax landscape, you can make the most of your investment returns while reducing your tax burden. So maximize your profits, knowing you’re keeping more of your hard-earned gains in your pocket!

Frequently Asked Questions

How can I legally avoid paying capital gains?

You can legally avoid paying capital gains taxes by utilizing the exclusion limits, offsetting gains with losses, picking your cost basis, moving to a tax-friendly state, donating stock to charity, investing in an Opportunity Zone, or using Section 1031 of the IRS code.

How long must you hold a stock to avoid capital gains tax?

To avoid capital gains tax, you should hold your stocks for at least a year before selling.

Additionally, investing in eligible low-income and distressed communities can provide the opportunity to defer taxes and potentially avoid capital gains tax altogether.

What is a simple trick for avoiding capital gains tax?

Invest in a retirement plan such as a 401(K) or an IRA to avoid paying capital gains tax.

Additionally, investing for the long term and holding assets for over one year can benefit from the lower long-term capital gain rate.

How much capital gains tax on $200,000?

Based on the facts provided, an individual would have to pay $ in capital gains tax on $200,000.

What is the difference between short-term and long-term capital gains?

Short-term capital gains refer to profits derived from the sale of an asset held for one year or less, whereas long-term capital gains indicate profits accrued from the sale of an asset held for more than a year.